Basic Approach

While placing importance on the relationship of trust with our shareholders and all other stakeholders, we will work to achieve sustainable growth and increase corporate value over the medium to long term. We will also aim to strengthen and enhance corporate governance, centered on the Board of Directors and the Audit Committee, to ensure transparent, fair, prompt and decisive decision-making.

Basic Policies

In line with the principles of the Corporate Governance Code, the Asahi Yukizai Group has established the following basic policies.

Securing the Rights and Equal Treatment of Shareholders (Basic principle 1)

The Company strives to disclose accurate information to all stakeholders in a timely and fair manner, while complying with relevant laws and regulations such as the Financial Instruments and Exchange Law and the listing rules established by the Tokyo Stock Exchange. In addition, to substantially secure the rights of all shareholders and to ensure the environment and substantial equality regarding the exercise of rights, the Company is committed to continuously improving shareholder relations at the Company and to responding appropriately and in good faith.

Proper Cooperation with Stakeholders other than Shareholders (Basic principle 2)

The Board of Directors and management of the Company have discussed and formulated a new Asahi Yukizai Group Corporate Philosophy. We recognize that we have been able to "provide peace of mind through reliable quality and diligent response," which is one of the values of our existence, through cooperation with various stakeholders, including employees, customers, suppliers, creditors, and local communities. We will continue to strive for the sustainable growth of the company and the creation of medium- and long-term corporate value through collaboration with various stakeholders in accordance with our corporate philosophy. In addition, our Code of Conduct stipulates "compliance with social norms" and "implementation of fair trade" as what we should practice, and under the direction and orders of the President and Chief Executive Officer, who is in charge of compliance, the Company strives to enhance compliance education for its employees.

Proper Information Disclosure and Securing of Transparency (Basic principle 3)

We recognize that information disclosure is one of the most important management issues, and in the Asahi Yukizai Group Code of Conduct, which serves as a code of conduct for our directors and employees, we stipulate that "we will actively disclose corporate information not only to shareholders and local communities, but also to society at large to enhance corporate transparency." In addition to disclosures required by law, the Company proactively discloses information (including non-financial information) deemed important to shareholders and other stakeholders through the Company and the Tokyo Stock Exchange website. We also strive to disseminate additional information through our website and other means to deepen understanding of our business and management initiatives.

Responsibilities of the Board of Directors (Basic principle 4)

The Company's Board of Directors is composed of directors, including members of the Audit Committee from outside the Company, each of whom represents a professional and objective viewpoint, and oversees the execution of management policies, such as corporate strategy, as well as the management of the Company and its subsidiaries. In addition, in accordance with the "Regulations of the Board of Directors," the Audit Committee members participate in the voting and make appropriate decisions on important matters related to management policies such as corporate strategies and the maintenance of an environment that supports appropriate risk-taking by the senior management.

Dialogue with Shareholders (Basic principle 5)

We recognize the importance of constructive dialogue with our shareholders in order to achieve sustainable growth and long-term enhancement of corporate value. To this end, the Corporate Planning Department and the General Affairs Department, under the supervision of the President and Chief Executive Officer, play a central role in promoting IR activities, such as holding briefings for institutional and individual investors. In these activities, we hold briefings on medium- and long-term management policies and conditions, as well as on the outline and progress of the medium-term management plan, and strive to deepen mutual understanding with shareholders through question-and-answer sessions and other means.

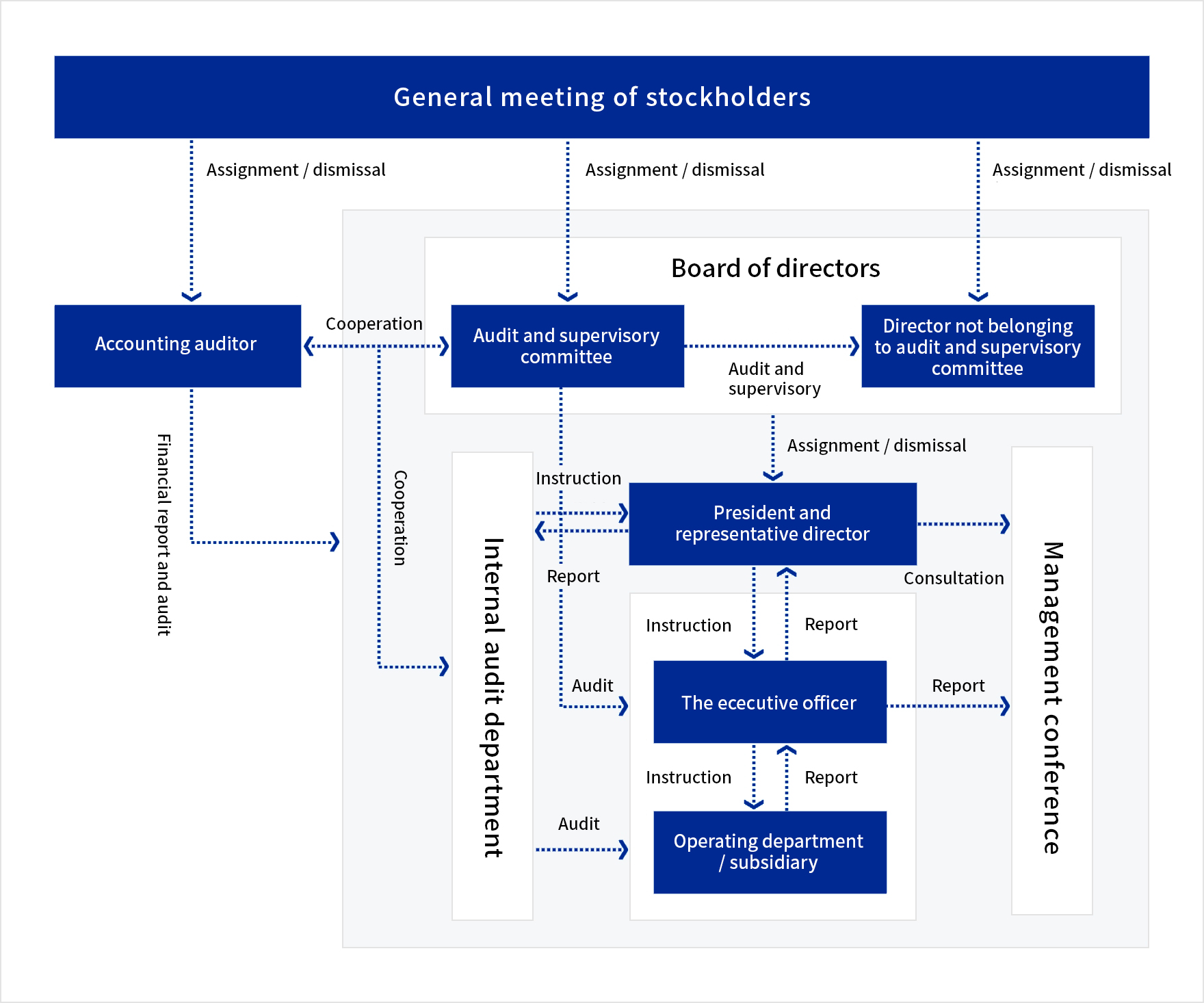

Organization Chart

This page was created based on the information contained in the Report on Corporate governance_2025.pdf updated

on June 30, 2025.

This page was created based on the information contained in the Report on Corporate governance_2025.pdf updated

on June 30, 2025.

Our efforts regarding the Corporate Governance Code (All 83 principles)

The following is the status of our efforts and policy regarding all 83 principles of the Corporate Governance Code at our company.

Criteria for Judging the Independence of Independent Outside Directors

The Company shall deem an outside director independent if they do not meet any of the following criteria:

-

(1) A person who is currently or has been in the past 10 years a business executor (executive director, executive officer, employee, etc.) of the Company's group.

-

(2) A person who currently or in the past 1 year has been a business executor of a person whose annual consolidated sales to the Company's group account for 2% or more of the total sales of the Company's group.

-

(3) A person who currently or in the past year accounted for 2% or more of the Company's annual consolidated sales, a person from whom the Company has borrowed 2% or more of its total consolidated assets, or a person who was the business executor of such a person.

-

(4) A person who currently or in the past year has received, as an individual, annual monetary or other financial benefits of 10 million yen or more from the Company's group.

-

(5) A person who currently receives or has in the past year received from the Company's group an annual donation or grant of 10 million yen or more, or a person who executes the business of such a person.

-

(6) A person who currently or in the past year held, directly or indirectly, 10% or more of the voting rights of all shareholders of the Company, or a person who was the business executor of such a person.

-

(7) A person who is or has been in the past year an executive officer of a company that has appointed a director or employee of the Company's group as a director or executive officer.

-

(8) A person who is or in the past year has been a representative member, employee, or employee of an accounting auditor of the Company's group.

-

(9) A person who is a close relative (spouse, relative within the second degree of kinship, or a person with whom one shares a common livelihood) of a person who falls under any of (1) through (8) above. However, for clauses (1) to (3) and (5) to (7), this only applies to key executives (such as executive directors, executive officers, etc.).

This revised text includes adjustments for accuracy, clarity, and consistency while maintaining the repeated structure of "A person who" for coherence across the criteria list.

Skill Matrix

Our company has identified the skills our Board of Directors should possess as seven key areas: (1) Business Management, (2) Sales, (3) Manufacturing, Safety, & Development, (4) Finance & Accounting, (5) Legal & Compliance, (6) Human Resources & Talent Development, and (7) Internationality. The current skill matrix of our Board of Directors is outlined in the table below.

|

Corporate Management |

Sales |

Manufacturing・Safety・Development |

Finance・Accounting |

Legal Affairs・Compliance |

Human resources・Human resource development |

Globalization |

President

Kazuya Nakano

|

〇 |

〇 |

|

|

|

〇 |

|

Director

Sueyoshi Suetome |

〇 |

|

〇 |

|

|

〇 |

|

Director

Hideo Hikami |

|

|

|

〇 |

|

〇 |

〇 |

Director

Osamu Sameshima |

〇 |

|

〇 |

〇 |

|

|

|

Director

Takeshi Yamamoto |

〇 |

〇 |

|

|

|

|

〇 |

Director, Audit & Supervisory Committee Member

Daichi Arima

|

|

|

|

〇 |

|

|

〇 |

Director, Audit & Supervisory Committee Member

Toshiko Kuboki |

|

|

|

|

〇 |

|

|

Director, Audit & Supervisory Committee Member

Toru Nasu |

|

〇 |

|

|

〇 |

|

|

Director, Audit & Supervisory Committee Member

Minoru Fukui |

〇 |

|

〇 |

|

|

|

〇 |

* The above matrix does not represent all the knowledge possessed by each director.

Disclosure policy

Basic Policy

We aim to enhance our corporate value over the medium to long term through constructive dialogue with our stakeholders. To this end, we strive to disclose information in a fair, just, timely, and appropriate manner so that all stakeholders can deepen their understanding of our company.

Information disclosure standards

We will disclose information in a timely and appropriate manner in accordance with the Timely Disclosure Rules of the Tokyo Stock Exchange's Securities Listing Regulations, the Companies Act, the Financial Instruments and Exchange Act, and other relevant laws and regulations. Additionally, we commit to disclosing information deemed important or useful for enhancing understanding of our company, even beyond the requirements of these rules and laws.

Information disclosure system

The General Affairs Department serves as the department in charge of information disclosure and collects appropriate information in cooperation with each business execution department within the Company. The Company has established a system where information on important decisions is shared in advance by the secretariat of the decision-making body to the department in charge of information disclosure. The Company has also established "Operating Rules for Reporting Material Information" to ensure that material occurrences are promptly reported to the department in charge of information disclosure.

Method of information disclosure

Timely disclosures made in accordance with the Company's Timely Disclosure Rules shall be disclosed via TDnet (Timely Disclosure Network) provided by the Tokyo Stock Exchange, and shall be promptly posted on the Company's corporate website and announced to the media. Other disclosures will also be posted on our corporate website.

Management of insider information and quiet period

The Company has established rules for the management of insider trading, and appropriately manages information regarding material facts, and discloses such information in a timely manner.

In addition, to prevent information leakage and ensure disclosure fairness, the Company has established a "quiet period" from the day following the last day of each quarter to the announcement of financial results, in principle, during which the Company refrains from commenting on or engaging in dialogue about such information.

About future forecasts

The forward-looking statements such as forecasts, outlooks, and plans that we disclose are based on judgments made in accordance with information available at the time of disclosure, and include potential risks and uncertainties. Therefore, it’s highlighted that actual business performance may vary due to various factors.